Iuka Investor Group, Inc.

Iuka Investor Group, Inc. was established in 2023 by seven Beta Chapter alums, as a for-profit company, in order to make a $200,000 loan to Alpha Gamma Rho Beta Chapter Inc. (“House Corporation”). The Investment Company is proposing to raise at least $1.6 million in additional capital in order to refinance House Corporation’s existing mortgage debt. At Closing, the Investment Company will take a first mortgage on the property at 1979 Iuka Ave. (the “Property”). The Investment Company will invite AGR brothers and family members to participate in the investment.

Key Stats

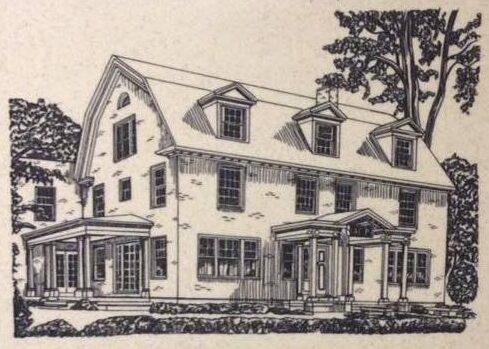

- 52-bed, 25-unit Fraternity House

- Address: 1979 Iuka Ave, Columbus, OH 43201

- Parcel: 010-000506, 0.997 Acres

- Constructed 1904; Renovated 2015

- Appraised: $1,910,000 (April 30, 2021 by CBRE)

- Current indebtedness: approx. $1.8 million, including $1.6 million to Citizens National Bank and $200,000 to the Investment Company

Current Situation

The Property was completely renovated in 2015 to meet all requirements for sophomore housing under the University’s Second-year Transformational Experience Program (“STEP”). In order to fund the renovations, the Corporation raised approximately $1.8 million in alumni donations and borrowed $2.4 million from Citizens National Bank of Bluffton (“Citizens”). The outstanding principal balance on the loan is approximately $1.5 million. The current interest rate is 5.15%. A balloon payment in the amount of approximately $1.6 million is due October 9, 2024. It appears unlikely that House Corporation will be able to refinance with a commercial lender.

PROPOSED LOAN

The Investment Company is proposing to make a five-year loan to House Corporation. House Corporation will be obligated to repay the loan, with interest. The Board of the Investment Company can decide, at the end of the loan term, whether to extend the loan or terminate the debtor-creditor relationship. Moreover, the Investment Company may foreclose on the property if House Corporation fails to make loan payments when due; fails to keep the property in good repair; fails to maintain acceptable occupancy levels; or otherwise fails to meet its obligations to the Investment Company. The objectives of the Investment Company and its principals include: (a) avoiding foreclosure of the Citizens mortgage loan and sale of the chapter house; (b) encouraging growth of the undergraduate chapter; and (c) encouraging House Corporation to maximize rental income from the property and operate in a fiscally-responsible and sustainable manner.

Opportunity To Invest

Any AGR brother or family member who meets the SEC definition of “accredited investor” is invited to become a shareholder/member of the Investment Company. Shares will be sold at a price of $1/per share and the minimum investment amount is $10,000. Investments are not guaranteed/insured and may lose value. Additional materials, including a term sheet, private placement memorandum, and subscription agreement will be available in early March 2024.

If you have questions, or are interested in participating, please contact Greg Flax, gflax@martinbrowne.com, (937) 459-2381 or Kent Walker, ksta12@yahoo.com, (937) 283-5079. Please consult your own attorney and/or financial advisor for investment advice.

I want to learn more about investing and receive the detailed information

If you have questions, or are interested in participating, please contact

Greg Flax

(937) 459-2381

gflax@martinbrowne.com

Kent Walker

(937) 283-5079

ksta12@yahoo.com